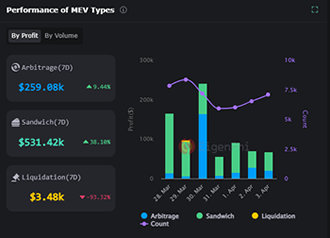

After closing the day of yesterday with a profit close to $1M, jaredfromsubway MEV bot is already profiting close to $400K today.

— triangularbot (@DeFiFlashloans) May 23, 2023

10:43 AM · Apr 19, 2023 Views 57.8K pic.twitter.com/rAwttOakM9

Why don't you run bots yourself but sell services?

- In fact, we run and manage the bot and smart contract ourselves only that you pay the fees on the exchanges.

In return you get the reward from trading and our developers receive an award for their scientific AI work in bot.. pic.twitter.com/RE5EDh7zlI— triangularbot (@DeFiFlashloans) May 15, 2023